Club 1872 is pleased to present an expert review of the latest Rangers accounts from one of our Contributors.

Rangers accounts, released last week, finally reached an inflexion point in the club’s recovery from the impact of 2012, with record revenue and an operating profit for this first time, driven by on-field success as the team reached a European final and the much-vaunted player trading model which kicked into gear with the sale of Nathan Patterson to Everton in January 2022.

Revenue

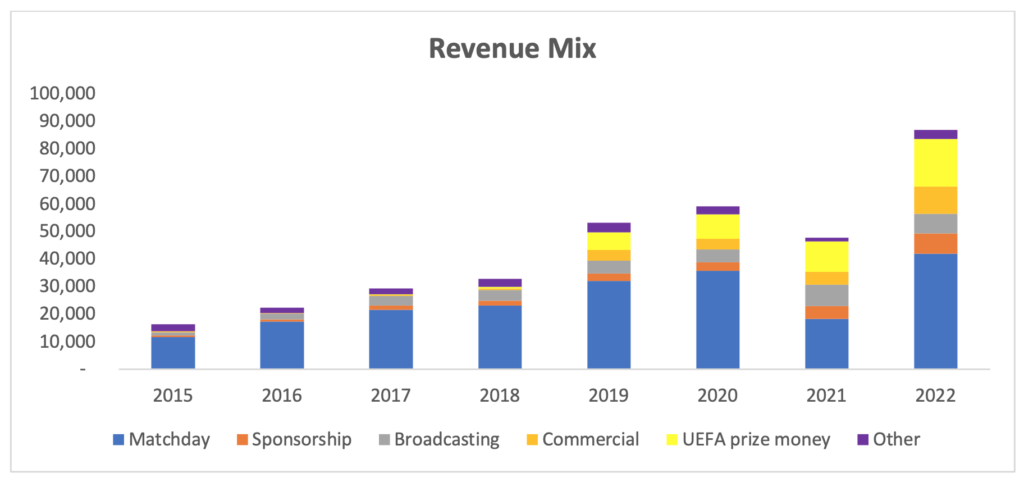

Rangers recorded its highest-ever revenue (£86.8m) in the year. It is worth noting that this does not include the sale of Nathan Patterson, which is treated elsewhere. Revenue increased 82% versus FY21 (Covid-19 impacted) and 47% versus FY20.

This year’s revenue growth has come in all the club’s revenue streams. The fans continue to be the primary source of revenue, with matchday revenue accounting for 48% of the club’s turnover at a quite an incredible £41.9m – £17.4m, of which was season ticket money. The Europa League prize money increased from £11.2m in FY21 to £17.3m. A modest increase given we reached the final. However, it is partly driven by poorer group stage performance (two wins and two draws versus four wins and two draws in FY21).

Commercial revenue was £27.7m in total, which is split as follows:

Interestingly, much of the above commercial revenue comes from the Rangers support rather than 3rd party agreements. James Bisgrove’s recent interview with Heart & Hand suggested that around 70% of commercial revenue comes from fan spending including RTV, MyGers and merchandise.

Other Income

Other income relates to the sale of Nathan Patterson. A gain of £11.2m was recognised regarding the disposal of player registrations, of which Patterson will account for the vast majority, if not all. It should be noted that the company’s cash flow statement shows that cash received in respect of player sales was £5.2m, a significant departure from the amounts that were briefed at the time to various outlets, including fan media, that most of the initial fee was to be paid upfront.

Expenditure

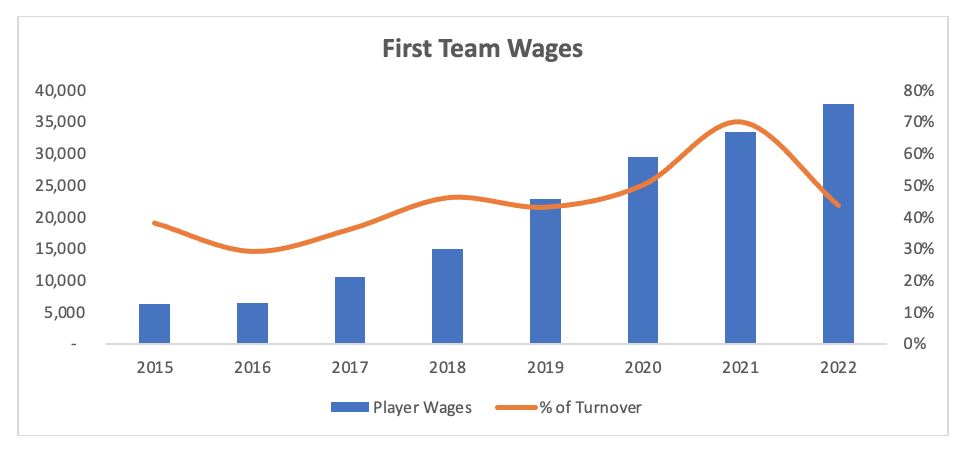

The club’s most significant expenditure is salary costs. We have seen a considerable increase in first-team wages in recent years, peaking at £37.8m this year, a 13% year-on-year increase. John Bennett also confirmed in his recent interview on RTV that the first team wage bill had further increased this year. Given the significant revenue increase, first-team wages were 44% of revenue. There does remain a risk that a poor European season could put this under severe strain.

Non-first team wages were £17.0m giving a total salary cost for the year of £54.8m (63% of turnover), a year-on-year increase of 15%.

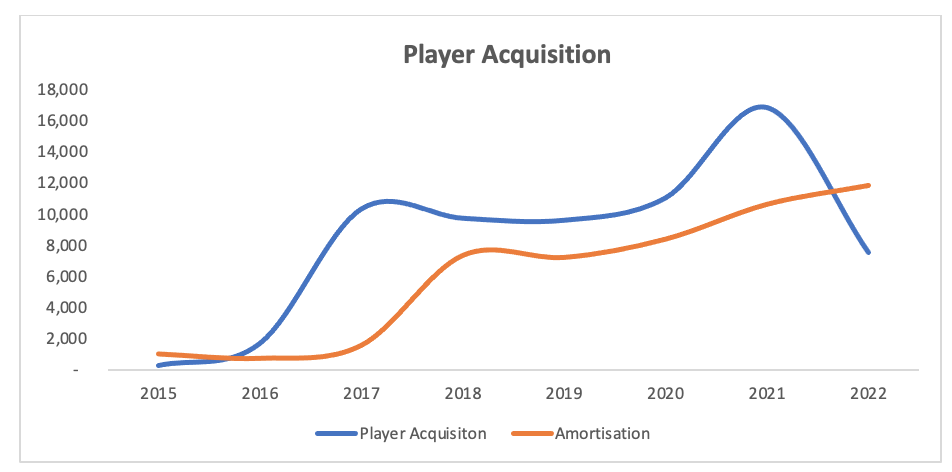

Player Acquisitions and Amortisation

Rangers have again invested in the playing squad. FY21 player acquisitions were lower than the previous five years at £7.5m. FY20 purchases were £16.8m as an example. The accounts note a further £15m being spent this summer; therefore, total investment in the playing squad has reached £60m in the last five seasons. As a result of the continued investment in the playing squad, player amortisation has also increased. In layman’s terms, when a football club sign a player, they do not expense the full transfer fee to the profit or loss account. Instead, it is included on the balance sheet and released over the length of the player’s contract. For example, the £3m transfer fee for Rabbi Matondo will be expensed at £0.75m per year of the four years of his contract.

The accounts also note that a further £15m was spent on players post year-end, i.e., the summer transfer window, taking the spend across the last five windows to £40m.

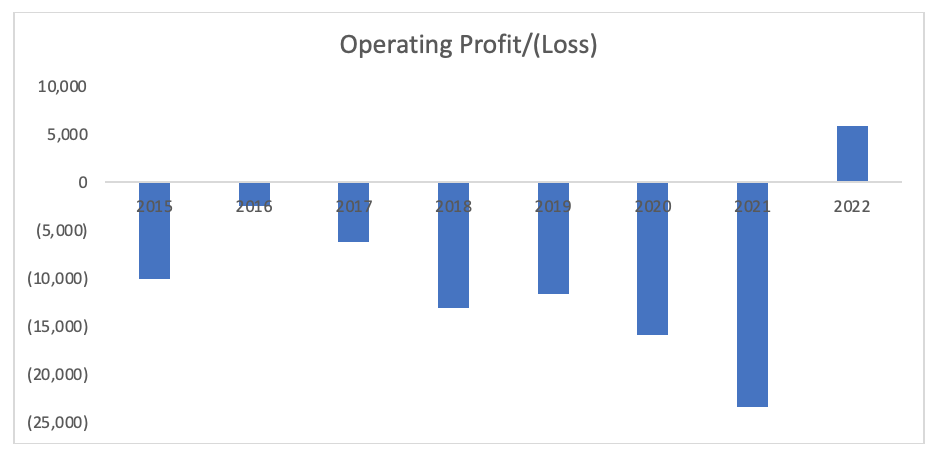

Operating Profit

The headline figure of a £5.9m operating profit is hugely encouraging and our first for some considerable time. The operating profit is driven mainly by the £5.2m of ‘Other Income’, primarily the £4.25m compensation received from Aston Villa for our previous management team and an insurance claim (presumably related to Covid-19 support). The payment to Sports Direct (more on this later) is not included in this figure as it is deemed a one-off cost.

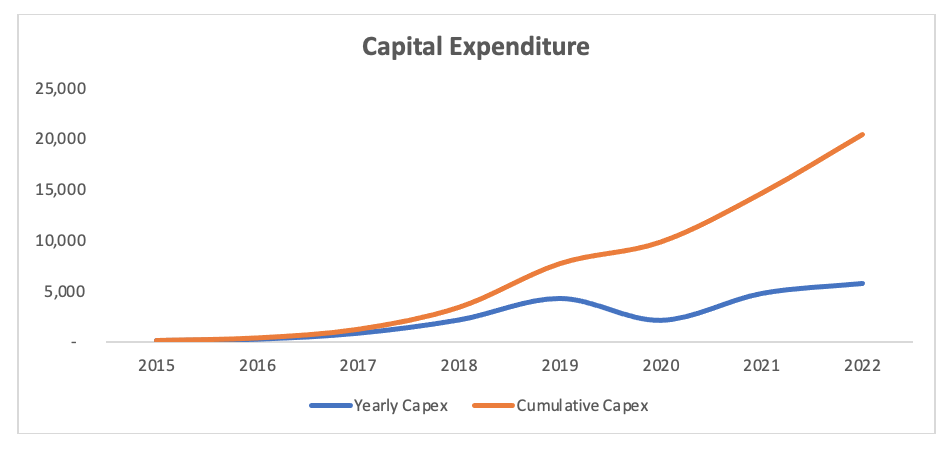

Infrastructure/Capex

As John Bennet pointed out in his RTV interview, the club spends considerable resources on Capital Expenditure. A total of £5.8m was spent in FY22, taking total Capex since 2015 to £20.4m – with over half of this in the last two financial years alone. It should also be noted that the accounts state that the club has committed to spending a further £9.6m – presumably related to completing Edmiston House and the Blue Sky Lounge.

Investors

There was a significant movement within the club’s funding during the period. The debt that the club carries has been rationalised and now remains relatively simple, with John Bennet (£10.3m) and Julian Woldhardt (£1.9m) remaining the only shareholders with loans in the company with additional facilities with an unnamed high street bank (£1.4m) and the Scottish Government Covid-19 support loan (£3.2m). Contrary to some speculation, the club is not debt free as can be seen from the table below.

| Debt | Amount |

| John Bennett | £10.3m |

| Julian Woldhardt | £1.9m |

| Bank Loan | £1.4m |

| Scottish Government | £3.2m |

| £16.8m |

The shareholder loans accrue interest at 6%, are secured against Edmiston House and are being repaid quarterly through to July-28. The loans can be repaid early and it remains to be seen if that is the case following the end of this accounting period using the funds received from the sales of Bassey. Aribo and from Champions League qualification. However, if it is in place through to its term, the interest payment on the loan will be a not insignificant £2.3m – mainly going to John Bennett.

John Bennett had his existing facility repaid in the year (£6.55m); however, the above facility was put in place after this repayment. Dave King had his loan facility (£5m) repaid in the year, as did George Letham (£2m).

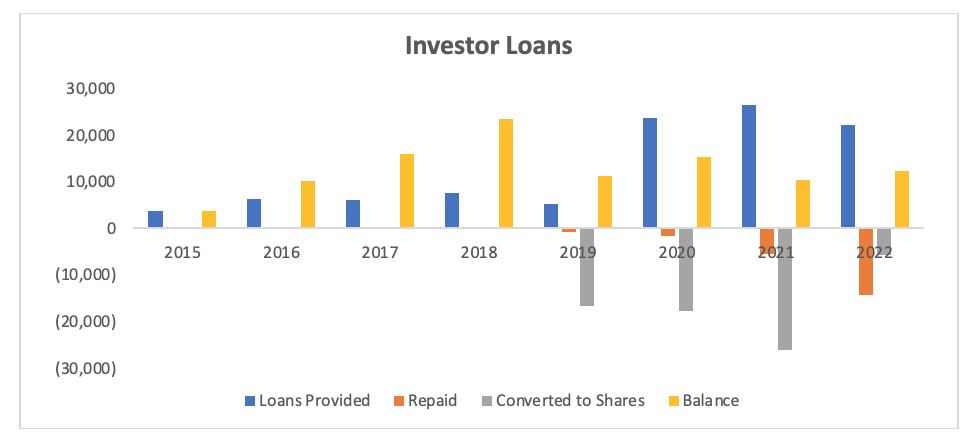

The latest facility from investors takes the total loans provided since the regime change in 2015 to £101m. Of this, £22.7m has been repaid, £66.1m has been converted to equity, and the remaining £12.2m is outstanding. It is now clear that the period of board members and investors providing loans to be converted to equity (shares) ended around the start of this calendar year. The club is having to repay funds out its own revenue to those investors, rather than releasing shares (which is essentially free to the club).

It is worth noting that Chairman, Douglas Park has not provided any loans during the period despite indications at the last AGM that this may be the case. In fact Park has not provided any loans or taken any equity for over 18 months. Parks of Hamilton (Holdings) Ltd have however entered into a commercial agreement with Rangers which appears to be worth £500k a year for 10 years. It is not clear what the terms of this agreement are or what Parks receive in return. The agreement was mentioned in the recent cinch court case and was put in place around the same time as the SPFL entered into their own commercial agreement with cinch.

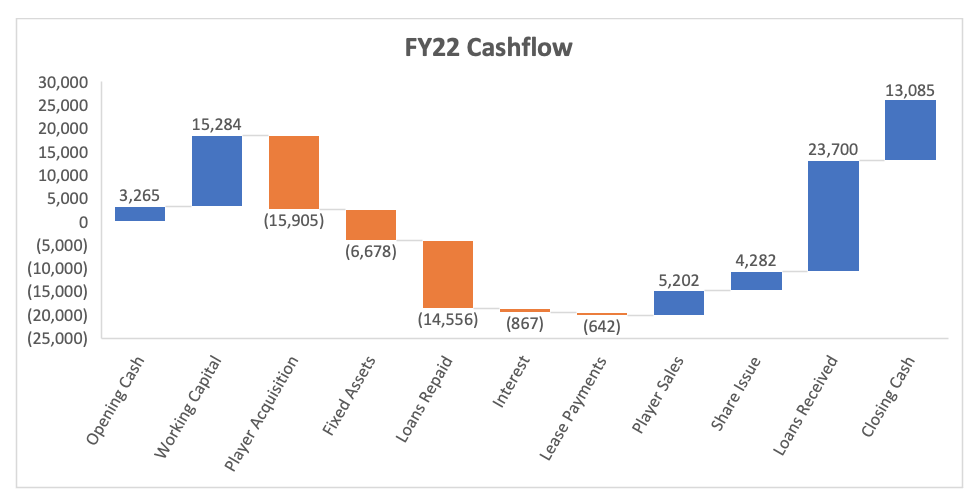

Cashflow

The club generated £9.7m of cash in the year. As shown below, the strong day-to-day trading performance yielded £15.3m cash. Player acquisition and Capex remain significant outlays (£22.6m) being supported by the sale of Nathan Patterson and additional investor loans.

Legal Disputes

A common feature of Rangers over the last few years has been very public court battles. This financial year was no different, with several disputes (old and new) playing out. Firstly, the prolonged battle with Sports Direct. The announcement in May that the dispute had been resolved was met well but with some degree of nervousness about the cost. Unfortunately, those fears have been well founded, with the disagreement costing the club £8.25m, of which £1.5m has so far been paid. The payment terms of the balance is unknown.

Unfortunately, this does not appear to be the end of the matter, with Sports Direct or affiliated brands releasing Rangers strips before the club and Castore suggesting there may be more to the settlement than just a financial matter.

A further cost of £1.25m is recognised for ‘other legal disputes’; however, these are not described. The club also acknowledges that it “is involved in a number of other legal disputes”. It is unclear what these relate to but one obvious possibility is the Sydney Cup debacle.

Interestingly, the previously mentioned legal proceeding initiated by Rangers against Elite for a sum of £2.3m, which the club believes is owed from previous retail operations, is no longer mentioned.

Summary

FY23 accounts will likely look similar, with Champions League qualification resulting in similar prize money figures as the run to Seville, given our dismal performance on the park, plus the sales of Calvin Bassey and Joe Aribo which were not included in these accounts.

Unfortunately, whilst one side of the player trading model has started to bring results in the form of transfer fees arriving with the club, it is difficult to argue that the buying side has. Close to £40m has been spent in the last five windows, and it is difficult to see that value on the park as the club languishes 7 points off the pace in the league and had an abysmal Champions League campaign. Indeed, just John Lundstram and Antonio Colak of those signed across those windows have played more than 50% of available minutes.

The average age of the squad has also increased and starting a Champions League game with nine players who played in Gerrard’s first season would not have been expected by the support coming into the season.

It is essential that the club capitalises on its current financial stability and does not stand still. Investor loans are now at an end with the club looking self sufficient for the first time in a long time. That is clearly a positive but there is a worry that some of the European and transfer income has at best not been used wisely and at worst has been wasted.

Views expressed in contributor blogs are those of the individuals who submit them and don’t necessarily reflect the views of Club 1872 or its representatives.

< Back